U.S. potato exports remain strong

March 8, 2022

From July to December 2021, most U.S. potato and product exports are above the levels for the same period in 2020. However, the figures for December are down, reflecting the supply and shipping constraints.

U.S. exports of frozen potato products increased by 9% from July to December 2021 compared to 2020, even though exports were off by 12% in December. These increases were led by a 41% increase to Canada, a 24% increase to Central America, and a 22% increase to Mexico, reflecting, in part, the easier shipping to these markets. Exports to target markets in Asia were up 3%, led by an 85% increase to the Philippines. The Philippines was severely impacted by COVID-19, resulting in serious declines in 2020, and thus, allowed for more of a rebound. Exports to Japan were up 6%, but due to problems with shipping and tight U.S. supplies, restaurant chains in Japan are limiting fry sales. Significant declines were seen in exports to Korea, down 14%, and Taiwan, down 12%. While both countries had limited impacts from COVID-19 and strong exports in 2020, the problems with shipping and U.S. supplies resulted in declines despite the strong demand. Restaurant chains in both markets are limiting fry sales and switching to alternative sources.

U.S. exports of dehydrated potatoes are not doing as well because the tight supplies from labor and raw product shortages and logistics issues restricted overall exports. Total exports were down 9% but did show some improvement in December, off only by 6%. All markets in Asia except Korea, up 83%, and Taiwan, up 27%, were down, with the largest market, Japan, down 26%. Both Mexico and Canada, two of the largest markets, were down 3% and 10%, respectively.

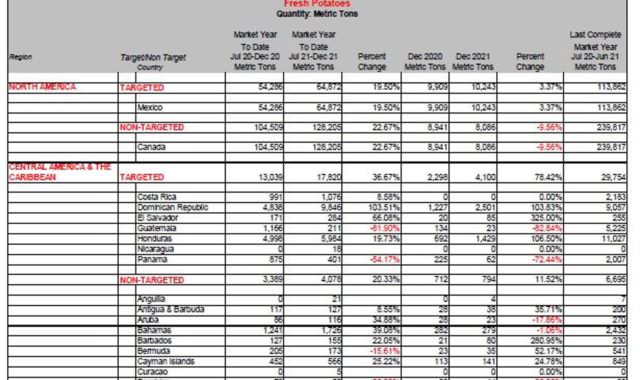

U.S. exports of fresh potatoes, which include table-stock and potatoes for processing, were very positive. The total was up 16% due to a 23% increase to Canada, the largest market by far, and Mexico, up 20%, despite the continued restrictions to the 26-kilometer border zone. Canada did have a 10% decline in December. Exports to Central America were up 37%, led by 104% growth to the Dominican Republic. Exports to Asia varied, with exports to Taiwan, the largest market, down 19%, as significant problems with rejections have limited exporters’ willingness to ship. The Philippines and Thailand were down 20% and 43%, respectively, due to strong competition from low-priced potatoes from China. Exports of chipping potatoes to Japan increased 285% due to a reduced harvest on the island of Hokkaido and the expansion to year-round access for U.S. chipping potatoes.

For details on U.S. exports, see the attached reports. Questions on the trade figures and Potatoes USA international marketing programs should be directed to Me***@*********SA.com. Potatoes USA accepts no liability for the content of these reports, or for the consequences of any actions taken based on any information contained herein.

More press updates from Potatoes USA

July 8, 2025

Grower Organizations Need Grower Involvement to Be Most Effective

July 7, 2025

U.S. Retail Potato Sales Volume Grows During the July 2024-March 2025 Period

June 11, 2025