U.S. potato exports continue to improve

November 17, 2021

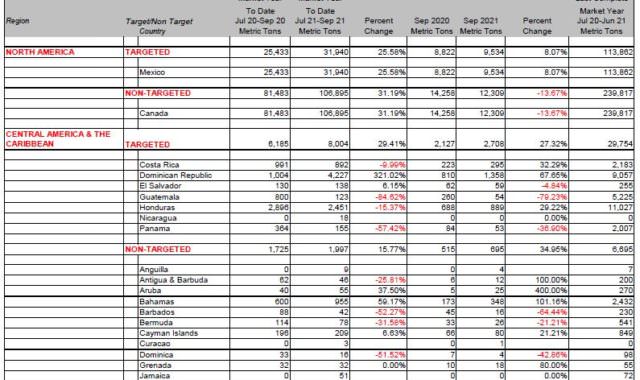

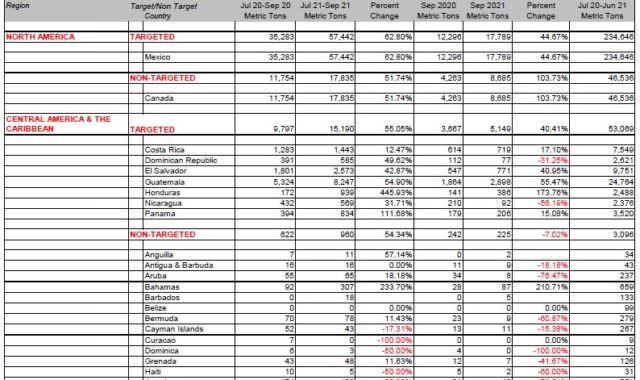

U.S. exports of frozen potato products increased by 30% for the July – September 2021 quarter compared to 2020. These increases were led by a 63% increase to Mexico, continuing exceptionally strong sales to this market throughout 2021. Exports to Canada and Central America were up 52% and 55%, respectively, with all countries in Central America posting growth. Exports to Potatoes USA target markets in Asia were up 18%, led by increases of 28% to China and 176% to the Philippines. Both markets were severely impacted by COVID-19 resulting in serious declines in 2020 and thus more of a rebound. Exports to Japan were up 14%, but due to problems with shipping and tight U.S. supplies, restaurant chains in Japan are limiting fry sales and switching to products from Canada. The only two markets to decline were Korea, down 14%, and Taiwan, off 3%; both countries had limited impacts from COVID-19; thus, exports remained strong in 2020. The problem now is with shipping and U.S. supplies, resulting in declines despite strong demand.

U.S. exports of dehydrated potatoes did not fare as well in part due to the fact that dehy exports were up in 2020. Further, tight U.S. supplies, logistics issues, and strong competition from Europe limited exports. All markets in Asia, except Korea, up 59%, were down with the largest market, Japan, off by 24%. Both Mexico and Canada, two of the largest markets, were down by 7% and 10% percent, respectively.

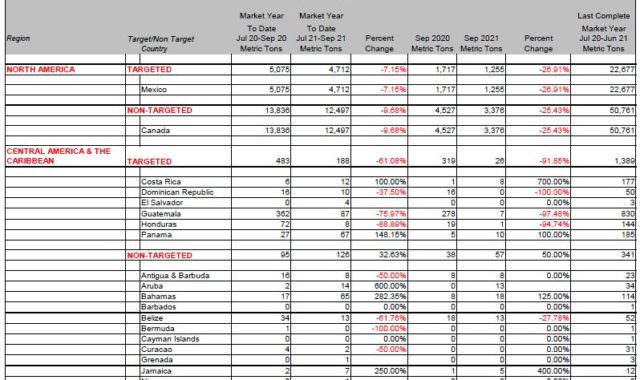

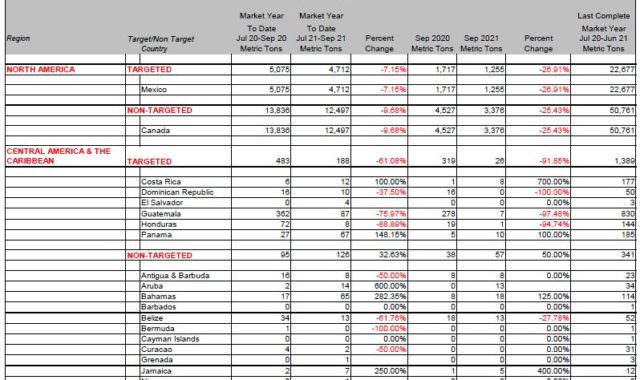

U.S. exports of fresh potatoes, including both table-stock and potatoes for processing, were more mixed. The total was up 16% due to a 31% increase to Canada, the largest market by far, and Mexico was up 26%, despite the continued restrictions to the 26-kilometer border zone. Central America was up 29%, led by 321% growth to the Dominican Republic. Exports to Asia varied, with exports to Taiwan, the largest market, down 24% as significant problems with rejections have limited exporters’ willingness to ship. The Philippines and Thailand were down 36% and 88%, respectively, due to strong competition from low-priced potatoes from China. Exports to Korea were up 86% as demand for U.S. table-stock potatoes continues to grow in this market. Exports of chipping potatoes to Japan increased by 54% due to a greatly reduced harvest on the island of Hokkaido.

For details on U.S. exports, see the attached report and spreadsheet. Questions on the trade figures and Potatoes USA international marketing programs should be directed to John Toaspern, John@PotatoesUSA.com. Potatoes USA accepts no liability for the content of these reports, or for the consequences of any actions taken based on any information contained herein.

U.S. Fresh Potato Exports: July – Sept. 2021

U.S. Frozen Potato Exports: July – Sept. 2021

More press updates from Potatoes USA

April 25, 2024

USDA Appoints 32 Members to Potatoes USA’s Board of Directors

February 2, 2024

Understanding Potato Perceptions and Consumption: Real-World Applications

December 14, 2023